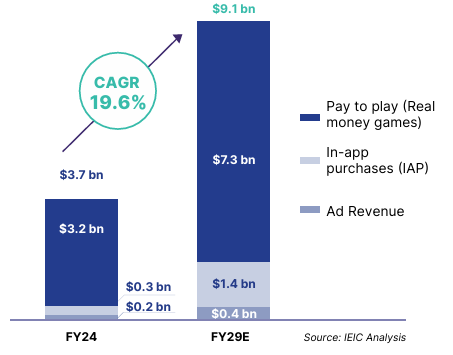

The Pay-to-Play segment continues to underpin and drive growth in the Indian online gaming sector and is expected to reach USD 7.3 billion by 2029E, up from USD 3.2 billion in 2024.

Among the Pay-to-Play segment, casual games are the key driving force as India builds on game development capabilities and online gaming companies continue to innovate. The industry fundamentals for the consumer tech segment in general, and the online gaming industry specifically, hold steady.

India’s online gaming sector performed better than expected, clocking a robust growth rate of 19.6% during 2024. While initial downward estimates were based on the impact of the GST increase on the RMG/Pay-to-Play sector, nevertheless, the industry size swelled to USD 3.7 billion in 2024, up from USD 3.1 billion in 2023.

Also Read: Decoding the Gamer: Gen-Z as Torch-Bearers for the Indian Gaming Industry

This increases its share of the global gaming market from 1% in 2023, to 1.14% of the ~USD 300 billion global gaming market as of today. With industry fundamentals holding strong, the Indian gaming market is expected to breach USD 60 billion size by 2034.

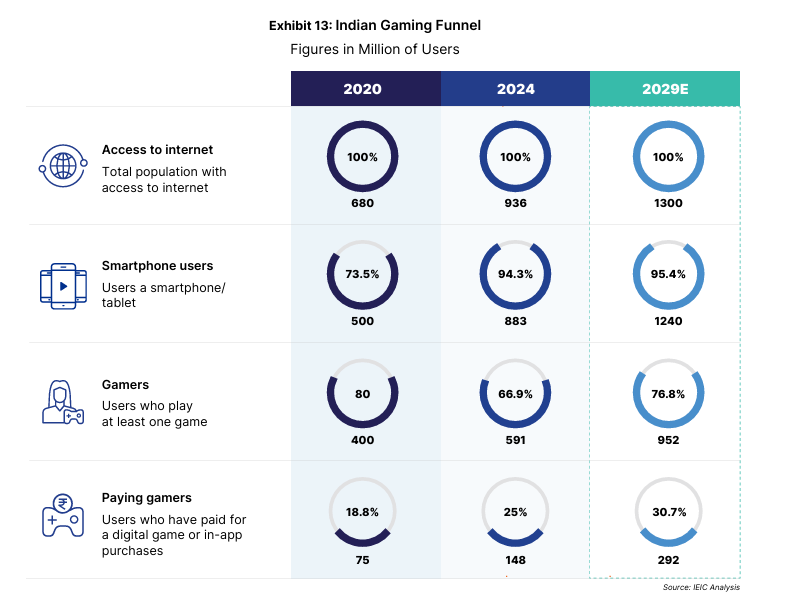

Numberspeak: The Indian Gaming Sector’s Paying Gamers Are Growing at a CAGR of 14.6% and Are the Bedrock of the USD 60 billion opportunity

The Indian gaming industry is fast becoming a powerhouse for employment creation, attracting global investments, and producing globally competitive content by solving the long-standing issue of monetization of gaming assets in India, as traditional monetization models of IAP and Ad Revenue have failed to succeed.

Also Read: India’s Unstoppable Ascent in Online Gaming: Consolidating the Global Dominance

Between 2020-24, the paying gamers user base grew at a robust CAGR of 18.5%. However, between 2024-29E, the CAGR of paying gamers is expected to moderate to 14.6%.

The share of paying gamers between 2024-29E is revised upwards due to the agility of the Real Money Gaming segment in adapting to shifting realities of the taxation headwinds which kicked off in October 2023.

The RMG segment continues to be the key contributor to the sector with over 85.7% revenue share, valued at USD 3.2 billion. This segment grew at a healthy rate of 17.8% during FY2024.

However, it is pertinent to note that these growth rates account for only six months of GST impact, effective from 1st October 2023. Industry reports have highlighted the adverse GST impacts on business viability.

However, given the changes over the 15 months since the introduction of new GST rates and valuation, the Pay-to-Play segment has shown remarkable resilience and agility to innovate to play the long game—by 2029E, the segment is expected to clock 18% CAGR to reach USD 7.3 billion market size.

Also Read: India’s Gaming Potential: USD 26 Billion Investor Value Waiting to be Unlocked

The dominant role of the microtransaction model in building a USD 7.3 billion pay-to-play sector by 2029E

India’s dynamic player demographics, evolving consumption patterns, and mobile-first gaming revolution ensured India became the content consumption capital of the world. For the last five years, India consecutively constituted over 15% of the global app downloads share. During this period, the Indian gaming sector also solved the protracted monetization issue for gaming content consumed in the country.

This resolution catapulted the Pay-to-Play skill gaming platforms into the spotlight as the undisputed revenue powerhouse of the country’s broader gaming industry, contributing a staggering 85%+ of the sector’s earnings. On the other hand, traditional monetisation pathways like IAP and ad revenue put together (or non-RMG monetization models) still constitute merely 14.3% of the revenue. By 2029E, this ratio is expected to consolidate 80:20, in favour of the Pay-to-Play segment.

The firmly established role of the Pay-to-Play segment makes it a very lucrative investment destination and allows it to create and absorb high-productivity global talent.

Also Read: Indian Gaming Report: The Vibrant and Heterogenous Landscape of Gaming Formats in India

This surge is largely fueled by India’s homegrown innovation of microtransaction-based monetization model. This game-changing innovation has redefined the viability of skill gaming companies in the country, and is powered by the government of India’s foresighted investments in digital public infrastructures like payment systems, such as the United Payments Interface (UPI).

The need for such innovations emerged from the lack of viable pathways to monetisation in the Indian context. In stark contrast to global benchmarks, alternative revenue streams popularly used by online gaming companies—such as IAPs and advertising revenue discussed above—yield significantly lower returns in India.

For the top 10 most downloaded apps globally, the average in-app revenue per download is 17 cents in India as compared to USD 2.86 globally and USD 12.4 in the US. For global investments, companies, and talent to enter the Indian gaming market, this discrepancy between content consumption and the inability to monetize games needs to be harmonized. To that end, the Pay-to-Play segment has been able to successfully plug this gap through the ingenious model of microtransaction-based monetization.

This compelling financial reality has made Pay-to-Play the go-to investment thesis for investors, attracting a phenomenal 90% of FDI (~$2.5 billion) into India’s online skill gaming startups in the past half-decade.

The meteoric rise of Pay-to-Play not only underscores India’s dominance in the skill gaming revolution but also aligns perfectly with the unprecedented influx of foreign investment, setting the stage for a new era of innovation, entrepreneurship, and global leadership in interactive entertainment.

Casual Games Underpin Sector’s Better-Than-Expected Performance

Among the Pay-to-Play/RMG segment , as per industry estimates, the fantasy sports segment is projected to run into degrowth up to 10% in FY 2025 owing to the high taxation regime. Apart from high taxation, fantasy sports may also lose out on growth on account of the proliferation of illegal sports betting and gambling platforms in India.

Also Check: Indian Gaming Report: The Vibrant and Heterogenous Landscape of Gaming Formats in India

Other gaming segments, as discussed earlier, are withstanding similar challenges due to innovations in game design and technology, rapidly evolving strong business models, and high-volume of user engagement.

Within the Pay-to-Play segment, casual games continue to be a major catalyst for growth. Apart from organic growth (such as the growing market of Indian casual gamers), business model innovation (to provide more engaging gaming experiences), and international expansion of gaming businesses (to new markets like Latin America, Europe, Southeast Asia, and North America), the category is also benefitting from the democratization of game development in India.

Within India, the State Governments continue to invest in the AVGC-XR sector and support game development at the subnational-cluster level, with clusters emerging in Delhi-NCR, Hyderabad, Bengaluru, Mumbai, and Chennai. Supportive policies have fueled casual game development, expanding into towns like Rajkot and Nashik while integrating India’s rich culture and heritage.

For example, games like Tanhaji: The Maratha Warrior (developed by AbracaDabra Software Solutions Pvt. Ltd. based Nashik, Maharashtra) and Unsung Empires: The Cholas (developed by Ayelet Studio based in Chennai, Tamil Nadu) are creating an immersive experience for Indian and global audiences truly rooted in Indian tradition and storytelling.

This also aligns with the vision of the Hon’ble PM when he urged the sector to make and export games using India’s rich culture and heritage. These developments have also led to the creation of richer content that truly underpins the growth of the casual gaming sector.

The non-RMG sector is also underpinning the rise of paying gamers in India, as well as profitable businesses powered by globally-accepted revenue generation models. The non-RMG sector’s revenue (earned through advertisement revenue and IAP) is expected to grow at a CAGR of 28% during 2024-29E to reach USD 1.8 billion from USD 0.5 billion currently.

Within this, revenues for the ad revenue segment is expected to increase to USD 0.4 billion by 2029E from USD 0.2 billion currently, growing at a CAGR of 11.2%. Separately, IAP revenue is expected to clock a CAGR of 38.3% during this period to reach USD 1.4 billion, from USD 0.3 million in 2024.

While these numbers remain very encouraging, the high growth rate is due to the low market size. While ad revenues are not seeing significant growth, IAP is surging as Indian gamers become more willing to pay for enhanced mobile gaming experiences, unlock new content, and make impulse purchases for one-off features.

Regardless of monetisation strategies, these wider ecosystem benefits and synergies between non-RMG and RMG gaming sectors fuel the growth of India’s gaming ecosystem, with revenues reinvested into innovation, R&D, and content creation. Additionally, their expansion strengthens the gaming workforce, encouraging talent to develop new technologies, IPs, and innovations that extend beyond RMG formats. The future of online gaming hinges on the joint success and growth of these two sectors.

Unlocking FDI and Investor Confidence: Global Investors Channel USD 2.5 Billion Into Pay-to-Play Segment

The steadfast ability of the Indian gaming industry to monetize content through microtransaction-led monetization model—and thus build highly scalable businesses—made it a favourite of marquee investors during 2019-22. Between 2019-2024, gaming companies at large raised USD 2.8 billion from domestic and global investors, amounting to 3% of total startup funding in India. It is pertinent to note, during this same period, that 90% (USD 2.5 billion) of this FDI was channeled into the Real Money Gaming (Pay to Play) segment. The Pay-to-Play segment made Indian gaming financially viable for global investors, because the lack of monetization was a protracted issue faced by the sector. 100% of this FDI is invested through the automatic route, due to the foresighted leadership of the Government of India, under the Electronic System and IT & BPM Sectors.

Global investments such as in online gaming remain an important ingredient for sunrise sectors like online gaming to invest in research and development, IP creation, and absorb globally competitive talent. It also helps the sector develop new-age technologies, cybersecurity protocols, real-time gameplays with low latency, immersive gaming experiences, and seamless payment processes.

Given the leading role online gaming plays in upskilling professionals drawn from other related sectors—like animation and visual effects—these investors have not just invested in the Indian gaming sector, but also in the larger Indian and global technology talent as well, offering unprecedented synergies to the online gaming sector. Their belief in the sector has helped online gaming companies in India reach unprecedented heights—best evidenced by the rise and public listing of gaming major Nazara Technologies, which currently serves as India’s first and only publicly listed gaming company. Sustained policy support—in the form of regulatory clarity for the sector in the form of distinct FDI regimes promoting pay-top-play skill gaming segments—can help unlock at least five more IPOs for online gaming companies in the next three years.

Exhibit 15: The pool of investors for online gaming sector and larger tech startup ecosystem is common

The Government of India’s Initiatives Lay Peerless Foundation for the Rise of Digital India and Online Gaming

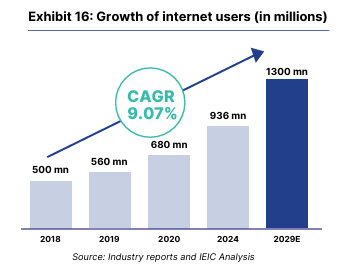

Exponential growth of internet users in India: The “next billion” users powering the rise of online gaming

Access to the internet forms the essential currency to survive and prosper in the age of the digital economy. India has a goal of driving a USD 1 trillion digital economy by 2030 and recent estimates by the Government pegs the share of digital economy in India’s GDP to increase to ~20% by 2030. To achieve this, there will be a continued focus on providing universal access to the internet to 1.5 billion Indians. By 2029, it is expected that 86.7% of the population will have access to the internet which will form the backbone of content creation, consumption, and monetization of the gaming economy.

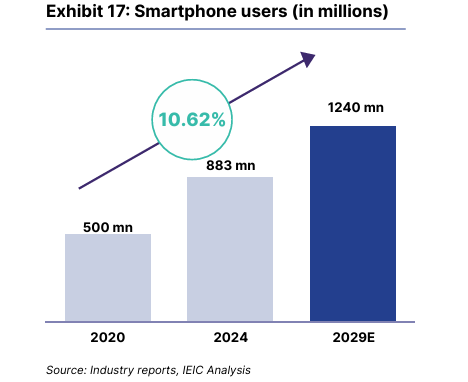

Increasing penetration of smartphones democratises access to technology and gaming for everyday indians

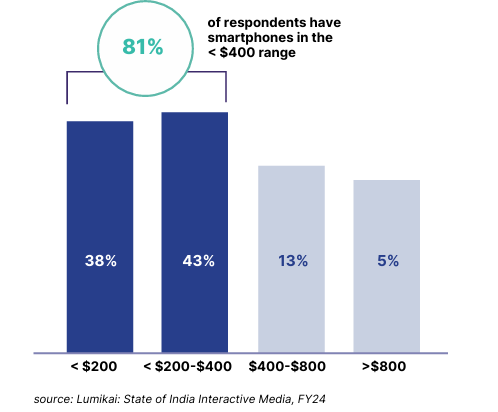

With over 200 mobile manufacturing facilities, India has now become the second-largest mobile manufacturing market in the world. The Government of India’s policies for Production Linked Incentive Schemes and Phased Manufacturing Programmes in the mobile manufacturing sector have played a critical role in expanding the domestic mobile manufacturing capabilities of India and increasing penetration of low-cost, high-specification mobile devices. As of 2024, smartphone users in India stood at 883 million, up from 500 million as of 2020. By 2029, the number of smartphone users is expected to go up by 1.2 billion. While 81% of the smartphones in India cost less than USD 400, the RAM specifications have jumped 5X over the last 5 years.

The access to high-specification smartphones makes gaming accessible to all, with a large share of the population benefitting from their high storage capacity, low latency, and better immersive experiences. Supporting connectivity to far-flung locations, smartphones have reached all nooks and corners of India before PCs and Consoles could, making India a mobile-first gaming market. New features such as foldable phones, larger batteries, faster charging, vapour chamber cooling, and high-resolution display enhance the gaming experience and encourage developers to provide more immersive content.

Exhibit 18: Access to affordable smartphones

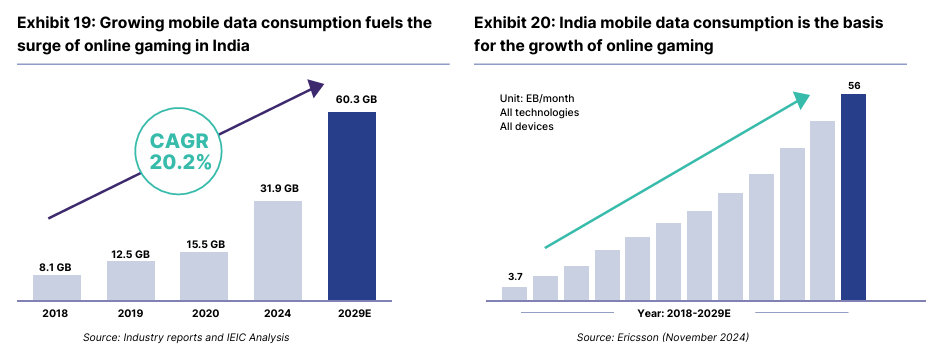

High consumption of affordable data fuels increasing consumption of mobile-based casual games

Access to high volumes of affordable data is a critical ingredient for the success of the gaming industry anywhere in the world, and India has led the way in providing this foundation. A competitive telecom regime laid the groundwork for Indians to access data consumption and connectivity at highly affordable rates—currently, the cost of internet data is as low as 12 cents per GB. India also has a distinguished record of enabling the fastest 5G rollout globally.

Access to affordable smartphones and 5G data has led to explosive growth of consumer tech, and therein online gaming, over the last five years.

The data consumption per user per month was 8.1 GB in 2018, and it increased to 31.9 GB in 2024. By 2029, this data consumption per user per month is expected to increase to 60.3 GB. The aggregate mobile data traffic (for India, Bhutan, and Nepal) is expected to increase to 56 EB/month (or exabytes) by 2029, up from 4 EB/month in 2018.

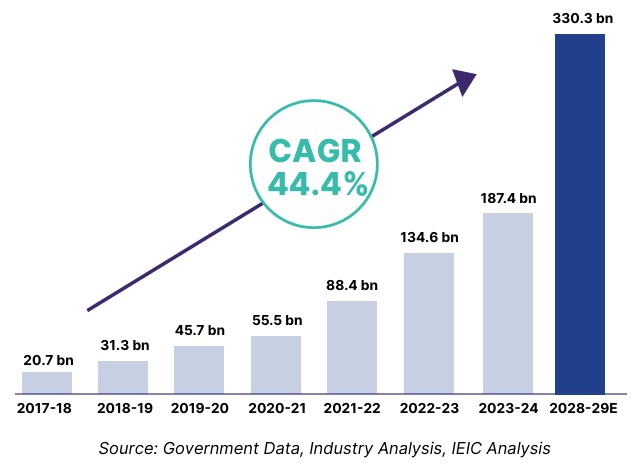

The Surge in Government-backed Digital Payments Infrastructure Powering Micro-transaction Based Revenues

The growth of United Payment Interface-led (UPI) digital transactions in India is a global success story of how digital public infrastructures can support innovation and digital inclusion—and has also led to the Indian innovation of microtransaction-based revenue models for online gaming.

Between FY 2017-18 and FY 2023-24, digital transactions in India have grown at an unprecedented CAGR of 46.9%. As per the ACI Worldwide Report 2024, in 2023, ~49% of the global real-time payment transactions happened in India. This peerless success in enabling digital transactions has unlocked value in the digital economy, including online gaming.

Exhibit 21: The Surge in Government-backed Digital Payments Infrastructure Powering Micro-transaction Based Revenues

The Indian Gamer has Spoken: Vernacular remains the mainstay

With one in every two gamers in India in the age group of 18-30 years (or ~43%), Indian gaming content has to build for their unique and youth-driven preferences, especially given that gaming is a new age form of interactive entertainment and 65% of Indians are under the age of 35 years.

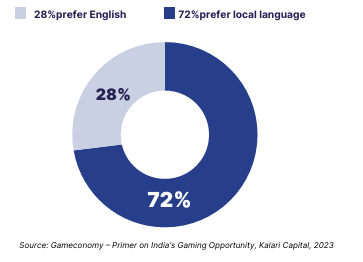

Similar to other forms of technology-driven content creation and consumption, vernacular content has emerged to be a clear winner in the gaming industry too. Over 72% of gamers prefer content in their local language. The democratization of content creation to Tier II to V cities, combined with the strong sense of community fostered by micro and nano gaming influencers specializing in vernacular content, further accelerates this trend in gaming.

This democratisation of content, and return to forms of entertainment derived from India’s ancient histories, indicates that India is now at a crucial juncture. The country is poised to build and make games in India, and for Indians, as opposed to simply consuming imported titles.

The Government of India is taking several policy and regulatory decisions to harness this creative and economic potential, and unlock the USD 60 billion opportunity awaiting it. If all stakeholders make good on these initiatives, then the value unlock for investors, developers, policymakers, and consumers will reach a level that would be a source of envy for new-age consumer tech sectors worldwide.

Exhibit 22: Preference of Indian gamers

Nitish Mittersain, founder of Nazara Technologies, began coding games at the young age of seven. After witnessing the rise of computer gaming in India—often played at cyber cafes of eras gone by—Mittersain decided to take the plunge and launch his own gaming company, Nazara Technologies (Nazara) in 1999. 25 years later, Nazara now stands as the only publicly listed Indian online gaming company, whose journey has inspired a generation of gaming entrepreneurs to continue building and developing entertaining games for India.

As of FY 2023-24, Nazara’s revenues stood at over INR 1,138 crore (USD 131 million). Nazara also has a distinguished accomplishment of commanding the highest premium among all the publicly listed gaming companies globally. At its peak, in January 2022, Nazara had a P/E Ratio of 241X and in 2024, highest P/E Ratio was 151X.

This high P/E premium can be attributed to Nazara’s success as an online gaming company as much as to the sound fundamentals of the online gaming sector in India.

How Nazara pioneered innovative monetisation strategies:

- In the early 2000s, Nazara pivoted from simply building online games, to offering them as “value added services” bundled with India’s rapidly growing mobile telecom subscription plans. This innovation signaled the entry of Nazara’s “microtransaction-based” model for online games, a blueprint that has informed the business plans of many Indian online gaming companies that have since followed it.

- It also spearheaded the rise of mobile-first gaming platforms in India—subsequent exclusive content creation deals with the biggest stars of the day, such as cricketing superstar Sachin Tendulkar, helped win the confidence of the public and early investors in the segment. It would not be remiss to say that this vote of trust, combined with India’s growing digitisation in the late noughties and 2010s, contributed to the growing experimentation and popularity of India’s online gaming sector.

- Nazara’s additional adoption of the freemium model in the 2010s—where games are offered for free on app stores and revenue is generated from in-app purchases—popularised innovative methods for Indian gaming companies to monetize their businesses.

- Nazara debuted on India’s markets in 2021, with shares listing at over 81% of the initial issue price. No other gaming company has reached such heights of market success—although many now aim to list their own ventures, after witnessing Nazara’s rise.

Creating gaming content for the world and pioneering the India gaming sector

Over the years, Nazara has developed successful games for varied age groups and segments, including:

Other exclusive games were made in partnership with the creators of well-loved Indian cartoon characters like Chota Bheem and Shikhari Shambhu

Nazara championed the development of indigenous gaming IPs, and India’s role in exporting world-class entertainment to global audiences.

It has also been at the forefront of using technologies like artificial intelligence and virtual realities in its game development processes, underscoring the axiom that the gaming sector has often been a critical first adopter (and innovator) of emerging technologies.

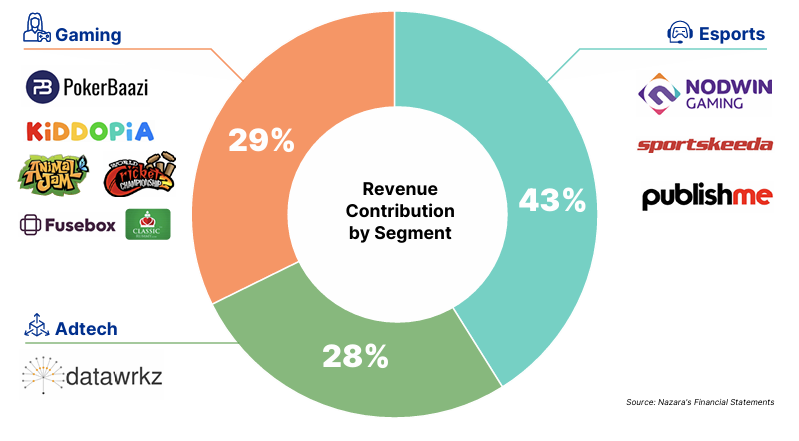

For example, Nazara’s strategic acquisition of esports company NODWIN in 2018, transformed the latter into a major leader in the category, with its revenues, valued at INR 427.1 crore (USD 49.1 million) in FY2023-24, growing over 25 times in the past half-decade. Nazara has also expanded its contribution from the RMG domain, through its recent investment in Moonshine Technologies, the parent company of one of India’s biggest online pay-to-play gaming companies, Pokerbaazi. One of its largest investments since inception—Nazara holds a 47.7% stake purchased for INR 831.5 crore (USD 95.7 million)—this development marks Nazara’s confidence in India’s pay-to-play skill gaming industry to succeed in the long term.

Nazara’s foray into digital marketing arenas, through its ad-tech segment Datawrkz, also marks its ambition to expand to all sides of India’s rapidly evolving digital economy.

Exhibit 23: Nazara’s segment-wise revenues

Supporting India’s gaming industry

Nazara’s future continues to build on these decades of innovation and sharp business decisions. In 2024, it launched the gCommerce platform in collaboration with the Government of India’s Open Network for Digital Commerce, an in-game monetisation platform that will help India’s game developers overcome the low in-app purchase rates they face, boosting their revenues in the process.

Alongside multiple plans for strategic expansion this year, initiatives like these, the hallmarks of the Nazara’s business acumen, will likely continue to shape the Indian gaming ecosystem. In more ways than one, Nazara has pioneered indigenous gaming business innovations that now form the bedrock of India’s thriving online gaming sector—Nazara’s success is synonymous with the sector’s.

Click Here for Full Report – Indian Gaming Report