India’s gaming sector has witnessed unprecedented growth, fueled by progressive policies, government support, robust fundamentals, and a steady influx of investments. The sector is ready to unlock USD 26 billion worth of investor value that will be ploughed into the larger Indian startup ecosystem and accentuate the flow of investment. The policy push for Digital Public Infrastructures like the Unified Payments Interface, and investments in frontier tech and AVGC-XR sectors, will further unlock value for the gaming sector.

The country’s new media market—comprising video content, animation/VFX, audio streaming, gaming, and social media—reached USD 12.5 billion in FY24. Recognizing this rapid expansion, the Indian government has intensified its focus on fostering innovation and supporting the uptake of emerging technologies, which are crucial for the gaming sector.

In 2025, Hon’ble Prime Minister Shri Narendra Modi while speaking in

Parliament acknowledged the sector’s phenomenal growth, stating that

India has the potential to become the gaming capital of the world.

Gaming companies have not missed on seizing the opportunities offered by the sector, and the encouraging policy signals, from the top leadership to state levels. In doing so, they have created businesses that have offered substantial benefit to the investor and the exchequer, which is even more notable since the sector is just five years old, and surpasses exchequer contributions from other new-age tech-based sectors. The question that begets interest and inquiry is how much investor value remains to be unlocked?

Also Read: Decoding the Gamer: Gen-Z as Torch-Bearers for the Indian Gaming Industry

Unlocking USD 26 Billion Investor Value: India is Home to 5 Gaming Decacorns and 10 Gaming Unicorns

India’s online gaming industry continues to scale, driven by substantial FDI, robust export potential in technology and intellectual property, and government support. The FDI received by the sector over the past five years stands at ~USD 3 billion, mostly directed to the Pay-to-Play segment.

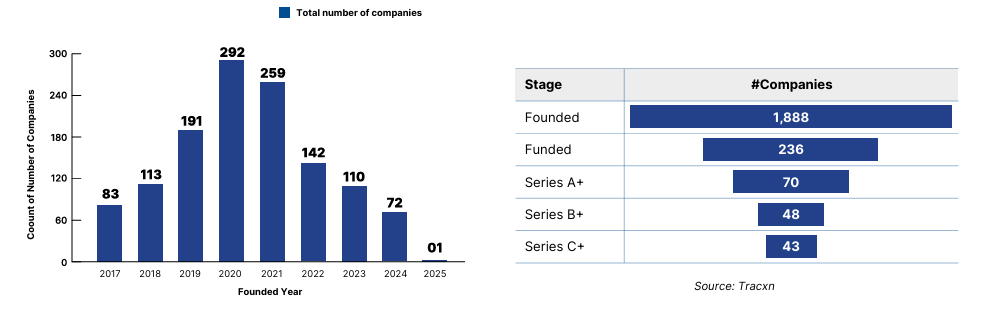

As per the Economic Survey 2023-24, 4% of the country’s new tech startups are also in the gaming sector. India is now home to over 1,888 gaming startups, of which, 236 have secured funding. Among them, 70 have reached Series A or higher, 48 to Series B or beyond, and 43 to Series C and beyond. The majority of the companies were founded in 2020.

Out of these companies, only Nazara Technologies has accessed the public markets, and commands a strong P/E multiple upwards of 100X, indicating investor’s willingness to pay the premium for the Indian gaming market. Nazara is a suitable North Star to assess the Indian gaming market given its diversified portfolio across RMG, Non-RMG, and game tech businesses, alongside its international presence.

Also Read: India’s Unstoppable Ascent in Online Gaming: Consolidating the Global Dominance

Based on Nazara’s Market Capitalization of ~INR 8000 crore (USD 917 million), and Revenue for FY2024 of INR 1,138 crore (USD 131 million), the Revenue Multiple stands at 7X. Given the current size of the Indian gaming market is USD 3.7 billion, and using a similar Revenue Multiple, it can be deduced that the Indian gaming market holds at least USD 26 billion worth of investor value waiting to be unlocked.

This is a conservative estimate as the Indian gaming market has a higher share of RMG (86%) as compared to Nazara’s share of RMG revenue (~40-50%), and because Indian public markets have moderated in Q3 and Q4 of FY2025.

Exhibit 24: The Vibrant Gaming Startup Ecosystem is Ripe to Unlock Investor Value

This USD 26 billion worth of investor value will be unlocked as soon as regulatory clarity crystallizes, laying the ground for at least 5 IPO-ready gaming companies to go public.

The five companies ready to access the public market include Dream11, Games24x7, MPL, WinZO, and Gameskraft. As these players move toward the public markets, they will unlock USD 26 billion worth of investor value that will be ploughed back to the larger Indian technology startup ecosystem. By 2029, the industry size will be USD 9.1 billion and with the same conservative Revenue Multiple of 7X, we are looking at over USD 63 billion worth of investor value being created.

Also Read: India’s Gaming Potential: USD 26 Billion Investor Value Waiting to be Unlocked

The Indian gaming companies are not only ready for the public market but will also carry the momentum on India’s stupendous record of new-age tech companies going global, inspiring investor confidence to drive up FDI, and creating a network effect for investor money to stay invested in India which will expand the pool for Indian startups.

The second order effect of such public market access will also reflect in job creation, increased FDI, adoption of frontier tech, boost in gaming IP exports, and ability to absorb top tier global talent.

The Concerted Policy Impetus Will Further Add Value Through Innovation and Digital Transformation

India’s Annual Union Budget builds on Prime Minister Narendra Modi’s vision for online gaming by prioritizing research, deep technology, and AI-driven innovations. The India AI Mission—the government of India’s apex mission promoting the use of Artificial Intelligence (AI received a significant budget increase to USD 230 million, up from USD 66.21 million in the previous fiscal year), and the establishment of a Centre of Excellence in Artificial Intelligence for Education, underscores India’s bold push toward a technology-driven digital economy.

Also Read: Indian Gaming Report: Delivering Enviable Growth and Investor Value Despite Headwinds

Furthermore, the introduction of a Deep Tech Fund of Funds aims to empower next-generation startups, including those in gaming, immersive technologies, and cloud-based platforms, doubling down on this mission. Given how frontier technology finds initial use cases in gaming, these policy and budgetary announcements will compound value creation for the sector at large.

Further, India’s broader strategy to enhance digital public infrastructure is exemplified by Aadhaar and UPI, which have played a transformative role in building a more interconnected and innovation-driven economy. Aadhaar has revolutionized digital identity verification (making it easier for gaming platforms to offer services responsibly to verified users), while UPI has redefined seamless financial transactions (helping sustain the successes of the microtransaction-backed model pioneered by the Indian pay-to-play industry).

UPI transactions are growing at a staggering 79.9% CAGR (FY20-24), reaching USD 131.1 billion in FY24, and played a critical role in solving the problem of monetization in gaming. Additionally, India’s rising per capita income (growing at a CAGR of 9% between 2020-24) is projected to hit USD 3,300 by FY26, and is driving higher consumer spending, reinforcing India’s position as a global powerhouse in consuming gaming and immersive technologies.

Also Read: Indian Gaming Report: The Vibrant and Heterogenous Landscape of Gaming Formats in India

Recognizing the immense potential of the gaming sector at large, as well as its parent AVGC-XR sector, the Indian government has taken significant steps to accelerate its growth and innovation. Efforts to support the AVGC-XR sector naturally feed into the online gaming sector’s rise in India, given that Gaming spearheads and anchors the larger AVGC-XR sector. A key initiative is the proposed National AVGC-XR Policy, aimed at positioning India as a global powerhouse in this space.

Several states, including Karnataka, Kerala, Rajasthan, and Madhya Pradesh, have already rolled out dedicated AVGC-XR policies, offering targeted incentives such as tax breaks, grants, and infrastructure support to attract investment and nurture talent. Encouraged by the sector’s rapid expansion, more states are actively working on their own AVGC-XR policies, further strengthening India’s reputation as a leading hub for gaming and AVGC-XR innovation and development.

Further, the National Centre of Excellence (NCoE) for AVGC-XR in Mumbai, announced in September 2024, is set to be a game-changer for India’s digital creative economy, accelerating innovation, talent development, and indigenous IP creation, and serves as a much-needed impetus for developing job-ready gaming professionals. With this strong policy push, and a thriving creative ecosystem, India is well on its way to becoming a global leader in gaming experiences.

The Government of India’s Coordinated Regulatory Push cements the Online Gaming Sector’s fundamentals

Online gaming is regulated from an interdisciplinary perspective in India, in recognition of the multiple sectors that come together to build games for mass audiences. The regulatory landscape is shaped by multiple key ministries and regulators, each of whom has leveraged specific policy measures to provide impetus and stimulate the domestic gaming sector’s USD 60 billion potential:

Ministry of Electronics and Information Technology (MeitY):

Ministry of Electronics and Information Technology (MeitY): MeitY has established itself as a pivotal force in shaping India’s digital economy and online gaming landscape. Since being appointed as the primary regulatory authority for online gaming in December 2022, the Ministry’s Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021 (also called Intermediary Rules) have recognized online gaming in India.

This appointment marked a significant milestone in bringing clarity to the sector’s previously ambiguous regulatory environment. Going ahead, MeitY’s intervention is expected to play a crucial role in fostering a fair online gaming ecosystem in India and ensure it remains competitive in the global market.

Also Check: Indian Gaming Report: The Vibrant and Heterogenous Landscape of Gaming Formats in India

Ministry of Information and Broadcasting (MIB)

MIB plays a crucial role in regulating online content and advertisements and promoting the growth of the AVGC-XR sector in India. It also plays an important role in curbing the promotion of offshore betting platforms. By issuing advisories to TV networks, digital media, and OTT platforms, the ministry has actively worked to prevent misleading advertisements related to illegal online betting and gambling.

Ministry of Commerce and Industry

The Department for Promotion of Industry and Internal Trade (DPIIT) within the Ministry enforces India’s Foreign Direct Investment (FDI) Policy, 2020. Moreover, the administration of intellectual property-related statutes, critical to protecting the cutting-edge IPs developed by game developers, is also overseen by the Ministry.

Ministry of Youth Affairs and Sports

In 2022, India officially recognized eSports as a multi-sport event and brought it under the jurisdiction of the Ministry of Youth Affairs and Sports, marking a pivotal shift in the nation’s approach to competitive gaming.

Together, these stakeholders provide regulatory and strategic direction to shape a balanced ecosystem and foster growth. On this strong regulatory foundation, the Indian gaming sector is poised for significant expansion, supported by a conducive policy environment and forward-looking regulations.

Jumping the Hoop: Industry Adapts to the Indirect Tax Hike

The Indian online pay-to-play skill gaming industry has shown remarkable agility to adapt to the GST hike from 18% on platform fees to 28% on total deposits in October 2023. While this initially posed risks on taxation liabilities and layoffs, the industry has adapted with resilience, realigning business strategies, and unlocking new avenues for growth. The pay-to-play sector grew at a robust rate of 18% in 2024, and by 2029E, the segment is expected to reach a USD 7.3 billion market size.

With domestic demand soaring and Indian companies expanding to global markets, the sector is regaining momentum, proving its strength and long-term viability, fortified as they are by strong and supportive underlying ecosystems.

As discussions around tax revisions continue, there is renewed optimism that a more balanced regulatory approach, where games are taxed based on their formats and not monetisation strategies, will further propel India’s gaming industry towards its USD 60 billion potential, fostering job creation, investment, and global leadership in the space.

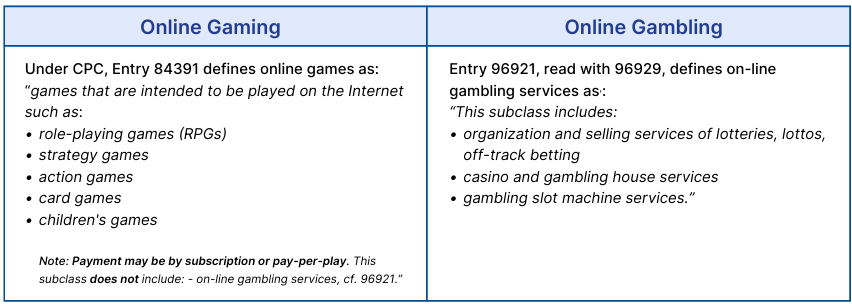

Exhibit 25: The distinction between online gaming and online gambling as per United Nations Central Product

Classification (CPC)

It has also been observed that the GST should be different across different formats due to the intrinsic differences between each format’s business models. Globally, benchmarks for product classification recognize this distinction. The United Nations Central Product Classification (UN CPC) and the North American Industry Classification System (NAICS) categorize online skill gaming separately from gambling, reinforcing the need for format-based taxation.

Aligning with such international standards could provide a more structured and growth-friendly regulatory approach, ensuring India’s gaming sector thrives while maintaining clear differentiation in policy.

To that end a format-based taxation framework, which recognises the intrinsic differences between gaming formats and taxes them fairly, may be an appropriate path forward.

Source: Path Ahead for Online Skill Gaming in India: Unpacking Global Standards for Regulating and Taxing Online Skill Gaming, USISPF and TMT Law A taxation regime focusing on actual revenue that also recognises the intrinsic differences between different formats—such as skill gaming, gambling, and fantasy sports—may help support the industry’s multi billion-dollar potential. Additionally, a downwards revision of the taxation rate can also help support this goal.

A recent report by the United States-India Strategic Partnership Forum and TMT law provides a comprehensive global review of the online gaming taxation policies for 12 global jurisdictions, confirming the international benchmark practice of format-based taxation based on platform fees. To view the report, titled “Path Ahead for Online Skill Gaming in India: Unpacking Global Standards for Regulating and Taxing Online Skill Gaming”.

Click Here for Full Report – Indian Gaming Report