The Indian gaming industry is home to multiple formats catering to a wide range of gamers with distinct content preferences. The gamers often experiment with different formats depending upon their motivations, willingness to pay, device specifications, and expertise, among other factors. The preferred games fall into the category of casual games and midcore games.

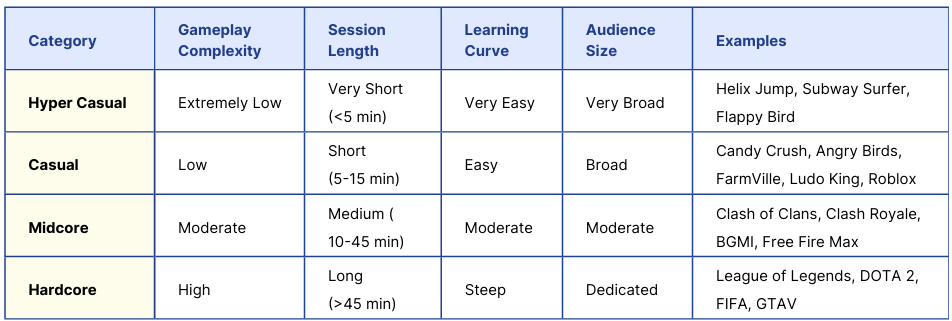

One key form of classification is based on “Game Depth” or “Audience Complexity” which categorizes games based on player commitment, complexity of gameplay, depth of mechanics, and target audience characteristics. Such categorization includes categories of Hyper casual, Casual, Midcore and Hardcore.

Another categorization of games is based on development budgets, production values, marketing investments, and quality of games, with key categories including AAA Games, AA Games, and Indie games. From highly popular hyper casual games that offer quick and accessible gameplay, to hardcore titles that demand skill, dedication, and high-performance devices, the Indian gaming industry has witnessed a significant shift in both development and player engagement.

Also Read: The “G” in AVGC-XR: How Gaming Spurs Creative Leaps Globally and Across Sectors

Innovation in India’s growing gaming industry is driven by diverse formats, each with unique business models and dedicated audiences. Formats are agnostic of monetization strategies—a casual or midcore game can be monetized through IAP, Advertising Revenues. However, across formats, the Indian innovation of a microtransaction-led monetization model (also called Pay-to-Play or Real Money Gaming) has emerged to be the most sustainable, scalable, and suitable form of monetization for the Indian gaming market that has been hard to monetise through IAP and Ads.

Understanding the fundamentals of these formats is critical when evaluating India’s next big contributions to the domestic and global gaming markets. They also hold the key to understanding the ever-evolving preferences of gamers in India and worldwide.

For example, in India, casual and hyper casual games have emerged as a clear winner given how a large share of the population has access to low-cost smartphones with low latency across India with varying internet connectivity. The shorter gameplay duration, wide range of gaming content, and immersive gameplay mechanics make it a preferred choice of games for Indian gamers.

Also Read: India’s Unstoppable Ascent in Online Gaming: Consolidating the Global Dominance

Exhibit 12: Game Categorization Based on Game Depth

Hypercasual and Casual Games: The Formats Driving Game Consumption In India

These are usually free-to-play games that offer easy gaming experiences, characterised by infinite looped gameplays, simplified 2D designs, and simple game mechanics.

- Number of players: 2024 estimates peg the userbase to be over 550 million.

- Monetisation models: Hypercasual games the fourth highest category for which gamers pay in India. The primary monetisation model for this segment, which typically involves free-to-play games, is in-app advertisement.

- Types of Players in this Format: These are typically played by mobile gamers and non-gamers, and marketed to a wide audience across age groups.

- Types of Hypercasual Games:- Helix Jump, Subway Surfer, Flappy Bird, Temple Run.

- Game Mechanics: Simple and easy to understand, enabling them to be played in small amounts, for longer periods of time.

- Gameplay Duration: Short sessions, often with quick rewards or progress.

Consumer Statistics and Trends in India:

- Rapid Growth and Popularity: Indian gamers have shown great proclivity for hyper casual games. They have gained traction due to their simple mechanics, quick gameplay, and accessibility.

- Affordability and Accessibility: These games are typically free to play and require minimal data, making them highly appealing.

- Localization and Cultural Relevance: The inclusion of regional languages like Hindi and Tamil has expanded their reach, attracting a diverse user base across different demographics.

- Emergence of Hybrid-Casual Games: Developers are blending hyper casual simplicity with deeper gameplay mechanics, as seen in games like Ludo King, which has surpassed 1 billion downloads worldwide.

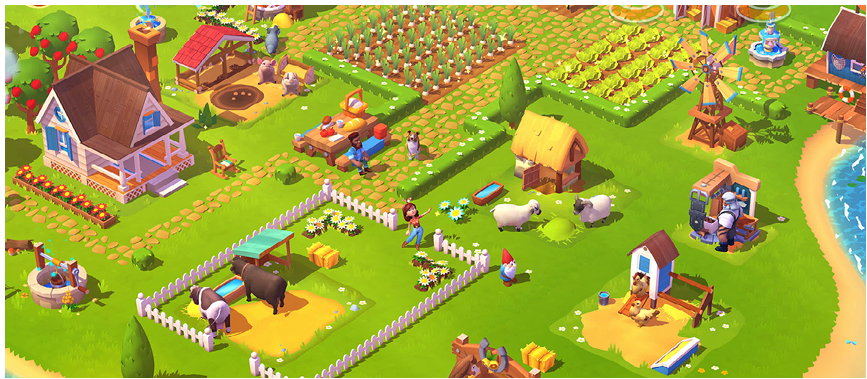

Casual Games: The Format Driving Game Consumption In India

Casual games comprise simple games with rules that can be easily grasped, providing them with mass market appeal.

- Number of players: Industry estimates from 2021 pegged the figure at over 420 million, with the figure likely to have crossed the 550 million mark in the past four years.,

- Monetisation models: Microtransaction-based models, an indigenous innovation for monetisation, have been instrumental in making casual gaming companies viable businesses in India. Over 80% of India’s gamers use the United Payments Interface to partake in micro-transactions, with casual games the third highest category for which gamers pay. Additionally, In-App Purchases localised to domestic spending appetites are the fastest growing revenue generator for casual games—and can start as low as INR 10.

- Types of Players in this Format: Marketed to gamers and non-gamers, who enjoy playing spontaneous games for fun.

- Types of Casual Games: Candy Crush, Angry Birds, FarmVille, Ludo king, Roblox

- Game Mechanics: Casual games are simple and easy to understand, and involve shorter game durations. However, they require a slightly higher learning curve, making them more challenging and immersive.

- Gameplay Duration: Short sessions, often with quick rewards or progress.

Also Read: India’s Gaming Potential: USD 26 Billion Investor Value Waiting to be Unlocked

Consumer Statistics and Trends in India:

- Rapid growth and popularity, owed to smartphones: Mobile gaming dominates in India and over 90% of gamers in India prefer playing casual games on smartphones.

- Growing availability of casual games: The rising prominence of casual games has led to a surge in the growth of game developers catering to this audience.

- Localisation and culturally relevant content: Multiple gaming companies, including the likes of WinZO, have begun offering games in Bharat’s many regional languages, tapping into new audiences and gaming segments outside of India’s metros., WinZO offers access to casual games in 12 Indian languages.

- Growing popularity amongst women: Estimates from 2024 suggest that over 40% of India’s gaming population comprises women, who demonstrate a predilection towards casual gaming experiences, among others.

Midcore Games: Making ‘complex’ games consumable to increasingly sophisticated audiences

Midcore games blend the simplicity of casual games with the depth of hardcore games. They often include multiplayer modes, allowing players to connect and compete with others.

- Number of players: Current estimates peg the number of midcore gamers to the tune of 350 million users.

- Monetisation model: Midcore games monetize their games mostly through in-app purchases. Midcore games also offer cosmetic paid upgrades, enabling users to upgrade skins, characters, weapons, and more for a personalized experience.

- Types of Players in this Format: Players seeking an engaging yet accessible gaming experience, that offers depth, without requiring excessive time.

- Types of Midcore Games : Free Fire Max, BGMI, Clash of Clans.

- Game Mechanics: Midcore games feature mechanics that are typically more intricate than casual games, yet not as demanding or detailed as hardcore games. Players require a basic understanding of gameplay strategies and mechanics to engage effectively. Compared to casual games, midcore titles offer a deeper learning curve, demanding players invest more time to master core strategies and gameplay nuances.

- Gameplay Duration: This involves a much longer game duration as compared to casual games—meaning that spontaneous play is less likely. However, games would still not necessarily run into hours.

Also Read: Indian Gaming Report: Delivering Enviable Growth and Investor Value Despite Headwinds

Consumer Statistics and Trends in India:

- Increased Engagement: As per Lumikai, Indian gamers spend an average of 3.8 hours per week on playing midcore games.

- Rising adoption of midcore games: Gamers who started paying with hypercasual and casual games in India are also showing increased proclivity for midcore games.

Hardcore Games and AAA Titles: Cutting-edge gaming experiences for the disciplined gamer

1. Hardcore Games

Hardcore games demand high skill levels, time, and player commitment, and often feature complex game mechanics and deep strategic elements. Common examples include massively-multiplayer online role-playing games (MMORPGs), multiplayer online battle arenas (MOBAs), and first-person shooter (FPS) games.”

- Number of players: The players of hardcore games in India are pegged at 150-175 million.

- Monetisation model: These games primarily monetise through Pay-to-Play and In App Purchases.

- Types of Players in this Format: Hardcore gamers dedicate significant time to gaming, with some streaming their gameplay to millions of followers online. These gamers prefer immersive and in-depth playing experiences.

- Types of Hardcore Games:- Valorant, Call of Duty, Fortnite, Black Myth: Wukong.

- Game mechanics: They offer deep storytelling, world-building, and exploration for an immersive experience.

- Gameplay duration: Gameplay typically lasts much longer for an individual contest, with estimates pegging average time spent on playing hardcore games by Indian gamers per week at 3.9 hours in 2024 (up from 3.7 hours the previous year).

Consumer Statistics and Trends in India:

Post-COVID, hardcore gamers increased by 40%, driven by high-performance smartphones and improved gaming experiences.

2. AAA (Triple A) Games

The classification of AAA games is based on investment and marketing budgets. AAA titles can be both midcore and hardcore and hence, they are a cross cutting category. AAA games are high-budget, high-profile titles developed and published by major studios, with development costs ranging from USD 60 million to USD 100 million. Players spend over 60% of their gaming time on AAA titles that were released more than six years ago, highlighting the longevity of successful franchises.

- Monetisation model: Monetisation models typically involve Pay-to-Play formats, with some paid content available for download later.

- Types of players in this format: Gamers seeking a high-quality experience and willing to spend on premium content.

- Types of AAA Games : FIFA, GTA5

- Game mechanics: AAA games drive industry innovation, pushing the limits of graphics, performance, and console capabilities for a more advanced gaming experience.

Consumer Statistics and Trends in India:

- Growth of Homegrown AAA Titles: Indian-developed games like Indus Battle Royale are gaining traction, with the title crossing 1million downloads soon after its launch in October 2024.

- Global slowdown: AAA studios face challenges like declining playtime, a saturated live-service market, an entrenched player base, and rising production costs for large-scale games.

Also Read: Decoding the Gamer: Gen-Z as Torch-Bearers for the Indian Gaming Industry

eSports Begins to Gain Traction

eSports is a subformat of video gaming, wherein individual players or teams take part in formal competitions dedicated to specific titles, typically in front of spectators. These games can vary from well-known, team-based multiplayer online battle arenas (MOBAs) to solo first-person shooters, survival-based battle royales, and digital recreations of real-world sports.

- Number of players: Data suggests that between 2016 to the present day, around ~48,000 eSports teams operate globally, although all may not be active. Some estimates suggest around ~1,500 competitive eSports players are active in India. Further, around 600,000 people casually play these titles in India, as of 2022, which industry estimates project to reach 1.5 million by the end of 2027.

- Monetisation models: Revenues are typically earned through pay-to-view models for tournaments, sponsorships for players, merchandising for teams, and tournament earnings (or prize funds).

- Types of Players in this Format:- eSports athletes are usually competitive gaming enthusiasts, with exceptionally strong motor skills, hand-eye coordination, and peripheral vision, that they work on enhancing through rigorous training. As for the audience, the contests target the attention of both casual gamers, and hardcore gaming enthusiasts. Globally, across North and Middle America, West Asia, and Southeast Asia, approximately 60% of eSports viewers tend to be male, while around 80% tend to be young, and either Millennials or Gen-Zs.

- Types of eSports Games:- Popular competitive eSports tournaments revolve around blockbuster titles like Call of Duty, League of Legends, Valorant, and BGMI.

- Game Mechanics: eSports games offer a deeper learning curve, strategic depth, multiplayer competitive gameplay, balanced gameplay, and replayability.

- Gameplay Duration: Individual matches within a competition vary based on game session time, ranging from 5 minutes for midcore games like Clash Royale to up to 45 minutes for hardcore titles like League of Legends. The overall tournament duration can span one to four hours, depending on the tournament round.

Consumer Statistics and Trends in India:

- Rising recognition of eSports players as athletes: eSports competitors are viewed as sports athletes, particularly post the recognition of eSports as an Olympic category in 2024, and the announcement of the forthcoming Olympic eSports Games to be held in Saudi Arabia in 2025. Indian competitors secured a silver medal in ‘Tekken 8’ at the Brazil, Russia, India, China, and South Africa (BRICS) Esports Championship, and a bronze medal in eFootball at the Asian Esports Games 2024.

- The Government of India’s plays an active role in supporting the eSports sector: In light of the growing affinity for professional and competitive gaming, the Government of India officially recognised “eSports” in the category of “multisports events”, and designated the Ministry of Youth Affairs and Sports as the nodal ministry overseeing the promotion of the sector.

- Challenges surrounding business viability: Despite the recognition, challenges remain such as limited monetisation prospects. Reports from 2024 suggested that the industry faced challenges as multiple eSports tournament organizers shut down due to insufficient brand sponsorships, making it difficult to maintain large-scale competitions.

Users’ Choice: Dominance of Hyper Casual and Casual Games in the Indian Gaming Market

The gaming industry’s continuous content creation and innovation across formats reflects the diverse demands of players and the rapid advancements in technology. While hyper-casual and casual games dominate the mobile gaming landscape with their accessibility and mass appeal, midcore and hardcore games, particularly AAA titles, are pushing the boundaries of immersive gameplay and competitive engagement.

In India, Daily Fantasy Sports has also emerged as one of the preferred formats for engagement across sports. India’s growing gaming ecosystem presents immense opportunities for developers, players, and investors, with multiple formats showing sufficient business stability, backed by strong technical expertise, making them a fertile ground to deliver successful investor returns.

This alongside, the wider sector’s underlying business fundamentals strengths shaped by the Government of India’s foresighted leadership, confirms the immense investor potential, as high as USD 26 billion, waiting to be unlocked.

Click Here for Full Report – Indian Gaming Report